Having a predetermined-rates loan, the interest remains the exact same to own an appartment period, constantly anywhere between 1 to five years

Offset Lenders

An offset home loan hyperlinks your financial so you can a bank account, the spot where the profit the account reduces the focus you have to pay on the mortgage. This will be a no brainer if you have nice offers one to you want to applied.

Interest-Merely Lenders

Which have appeal-merely finance, you only pay precisely the interest having an appartment period, typically 1 to help you five years, which leads to down monthly repayments first. It is better while you are focused on maximising cashflow, maybe to have an investment property, or in early values of one’s dental field.

Lower Put Home loans

Such loans are especially available for dental practitioners which might only keeps a good 5-10% deposit. Loan providers will promote these money with minimal otherwise waived LMI, which makes it easier to get in brand new Source aggressive North Coastlines property markets.

Credit line Funds

A personal line of credit financing makes you borrow funds up to an effective pre-set limit and just shell out appeal on which you utilize. Its versatile and will become of good use if you would like money for renovations or any other highest costs.

Plan Mortgage brokers

Bundle loans bundle some borrowing products, just like your financial, playing cards, and deals profile, have a tendency to that have deal rates of interest and you can charge. Such financing is the most suitable if you are searching getting benefits and you can coupons across multiple borrowing products.

Qualifications Conditions for Dentist Home loan

Securing a mortgage because the a dental expert into the North Shores, Questionnaire, will be an easier processes as compared to most other disciplines, thanks to the monetary stability and you will large money regular during the dental care profession. Yet not, there are certain eligibility conditions you to definitely lenders tend to determine to decide your own suitability for a mortgage. Some tips about what you have to know:

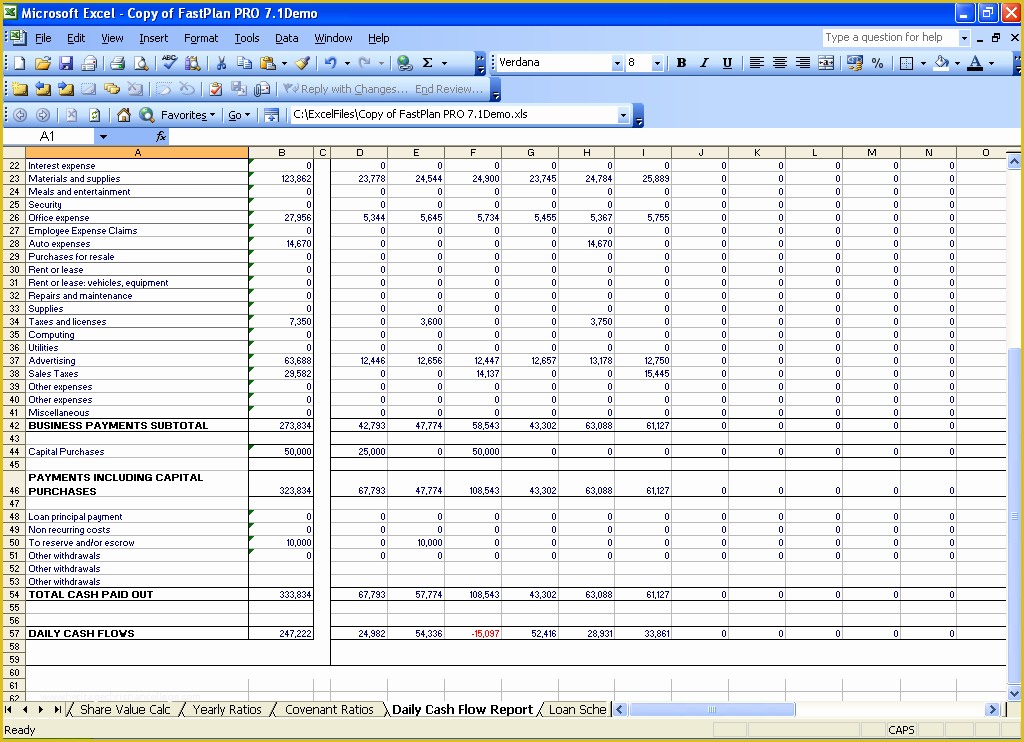

- Evidence of Income and A career Balance: Loan providers need to pick consistent proof money, typically using your taxation statements, bank comments, and you can current payslips. When you are thinking-operating otherwise run your own dentist, you might have to give one or two years’ value of financials, including profit-and-loss comments, to show your income balance.

- Credit rating: Good credit score is essential. Lenders often look at the credit history to be certain you’ve got good strong track record of paying expenses. While the a dental expert, a powerful credit score may also be helpful your secure way more beneficial mortgage terms and conditions, including straight down rates and higher credit limitations.

- Deposit Requirements: Many homebuyers are essential getting a beneficial 20% deposit, dental practitioners can often safer home financing that have in initial deposit just like the reasonable as 5-10%. Specific lenders actually give waived or smaller Lenders Financial Insurance (LMI) for dentists having less put, which is eg useful in large-pricing portion such as North Coastlines.

- Debt-to-Income Proportion: Loan providers have a tendency to evaluate your debt-to-earnings ratio , hence compares their overall month-to-month debt payments into disgusting month-to-month income. Because the a dental practitioner, the ample earnings usually works on the go for, however, staying almost every other debts reduced usually next improve your credit stamina and you will eligibility.

- Long lasting Home or Citizenship: Getting entitled to a mortgage in the North Beaches, you should be an Australian resident otherwise hold permanent property. Non-owners could possibly get deal with extra analysis otherwise restrictions, it is therefore crucial to ensure that your property condition is obvious whenever applying.

- Property Type of and you can Area: Loan providers might have certain criteria in line with the brand of assets you want to to get, especially in a paid markets such as for example Northern Shores. That they like features one hold otherwise enhance their worthy of through the years, very novel or low-practical functions might require a larger put otherwise attention higher desire rates.