Main Lender out-of Asia Financial EMI Calculator

The fresh Central Bank away from Asia Home loan Calculator is an essential tool having possible borrowers. They helps with choosing brand new month-to-month money considering some other financing amounts, interest levels, and you can tenures. Of these considering trying to get a loan, the home Financing Qualifications Calculator provide next direction.

Planning your mortgage repayments gets easier on the Main Lender of India Mortgage EMI Calculator. Which device can help you calculate your own month-to-month EMI, making it possible for ideal financial thought. To own a thorough research, check out the Mortgage EMI Calculator.

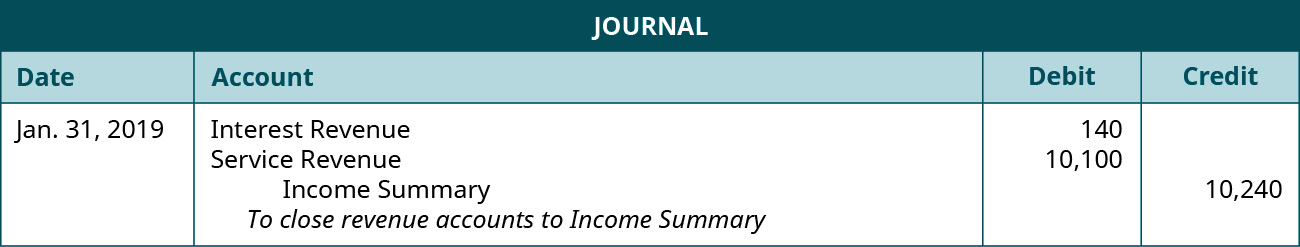

Essential Economic Regions of Central Financial off Asia Home loans

Knowing the crucial financial areas of mortgage brokers is essential to possess people debtor. The fresh Central Financial out of Asia brings transparent and you may competitive offerings so you’re able to meet the requirements away from a wide clientele.

Interest levels Data – All you have to Discover

Interest rates for the Main Lender regarding India lenders was competitive, which have pricing anywhere between 8% right up. This makes it more relaxing for individuals in order to safer that loan in the a repayment-productive speed, making certain owning a home is far more available to a greater listeners.

Fees and you may Costs – Outside of the Rate of interest

Apart from the interest rate, individuals should think other costs and charge. These may were an optimum Rs API consolidation costs, that covers the price of control the mortgage software and you can maintaining the latest membership.

Paperwork Fees – Keeping It Transparent

This new Central Financial off India maintains openness in its documentation fees to own lenders, making certain that borrowers are very well-informed about all will set you back on it.

- A nominal payment, with a maximum of Rs 20,000, try energized to pay for expenditures associated with control the borrowed funds app. So it payment comes with the purchase price for legal confirmation of possessions documents, undertaking a home loan, or other management tasks.

- The lending company also levies API combination costs of Rs five hundred, a tiny rates on capacity for seamless file addressing and you will verification processes.

By keeping these can cost you obvious and you can initial, the lending company will create believe and steer clear of one unforeseen financial load to your debtor.

Quantum regarding Financing – Just how much Might you Use?

The brand new Central Bank off India assesses the new quantum off mortgage dependent on repaying capability of candidate, which is actually determined by factors including normal earnings additionally the annual money-wise graded proportion. The financial institution ensures that candidates with a https://simplycashadvance.net/payday-loans-la stable disgusting annual income can secure an amount borrowed you to goes with their homes requires while also aligning with their financial stability. This approach assists with tailoring financing number which might be reasonable and you will lined up on borrower’s economic views.

Navigating the application Procedure

Applying for home financing at the Central Bank regarding Asia was streamlined to greatly help candidates in the navigating the method with ease. On first query with the last approval, the bank provides advice and support, making certain that people see each step of the process. So it supportive means is designed to improve journey on the protecting a home loan clear and less overwhelming for prospective home owners.

Qualification Criteria – Ensuring You Meet the requirements

The Central Bank out of Asia have lay obvious qualification criteria for its home loan candidates to ensure a straightforward procedure. Towards the big date out-of application, the financial institution analyzes if people meet the lender out of Asia household loan qualification, which has which have an effective lakh or even more in the typical income and you will being element of approved co-surgical communities. It ensures that applicants with a reliable income load are considered, deciding to make the process reasonable and obtainable.

Data Expected – Making preparations Your application

Getting mortgage applicants, this new Central Bank of Asia need some secret documents in order to processes the applying. They are name and you will address proofs particularly a pan credit, Aadhaar credit, Voter ID, and you will driving license. By giving these types of data files, people boost the lender in the verifying their name and home, that’s a vital help your house application for the loan techniques.