How can The Hampshire HELOC pricing compare to most other claims?

When determining ranging from on the internet and local HELOCs, it comes down to help you personal preference and you may interest rates. If you’re wary of on the web lenders and choose use a beneficial financial having a reputation you understand and you may trust, a neighborhood financial would be best for you.

Yet not, whenever you are technology-smart and you can worried about acquiring the low rates you’ll be able to, on the web loan providers tend to provide ideal prices due to having all the way down overhead will cost you. On the internet loan providers can also render smaller financing disbursement times as compared to traditional lenders.

It makes sense to compare costs and terminology away from 3 to 5 lenders to ensure you get the very best HELOC. Even a 0.25% difference between rate of interest can help to save high currency over the movement of your HELOC title, so it’s value finding the time to track down rates off on line and you can regional banking institutions.

Depending on the Wall surface Path Journal, an average HELOC speed all over the country are 8.61% by pshire’s on the internet and local lenders give cost carrying out from the six.24% and you will availableloan.net small business loans six.49%, respectively, that’s aggressive compared to federal averages.

To discover the best prices into the New Hampshire, you will want expert borrowing, and your eligibility vary according to lender. Mediocre prices cannot fluctuate far anywhere between states, but some says have more financial loans than the others.

For the The newest Hampshire, you have access to several online loan providers, also Shape and you may Hitch, which gives you alot more options to compare whenever locating the best HELOC. Studies of Zillow signifies that the common The latest Hampshire house worth was upwards 8.9% over the past 12 months, and that means potential extreme equity increases for some home owners.

Exactly what people wish to know

At exactly the same time, study signifies that New Hampshire’s mediocre credit limit having HELOCs is actually $125,536 greater than the new federal mediocre, that was $117,598 into the 2023. This can be likely as a result of the highest mediocre household speed inside The latest Hampshire, which is $479,363, centered on Zillow.

Ways to get an informed HELOC cost from inside the New Hampshire

- You really have security of your house. Very lenders need you to individual at the very least fifteen% in your home.

- You have good credit. In order to qualify for a good HELOC, loan providers favor FICO credit scores over 650, however, those with higher credit a lot more than 700 get be eligible for the most useful prices.

- Research rates. Prequalify to have an excellent HELOC which have 3 to 5 lenders so that you has multiple offers to compare.

- Lower debt: Lenders estimate your debt-to-money proportion when choosing whether or not to agree your to have a HELOC. When you can reduce debt adjust it proportion, you could potentially be eligible for straight down rates.

Any kind of New Hampshire-certain requirements or legislation?

The Hampshire has many user shelter rules you to definitely end lenders of providing advantage or becoming unnecessarily competitive whenever meeting debt. Eg, The new Hampshire rules RSA 358 increases the new government definition of a loans collector and you will prevents them out-of becoming unfair or inaccurate whenever trying collect an obligations.

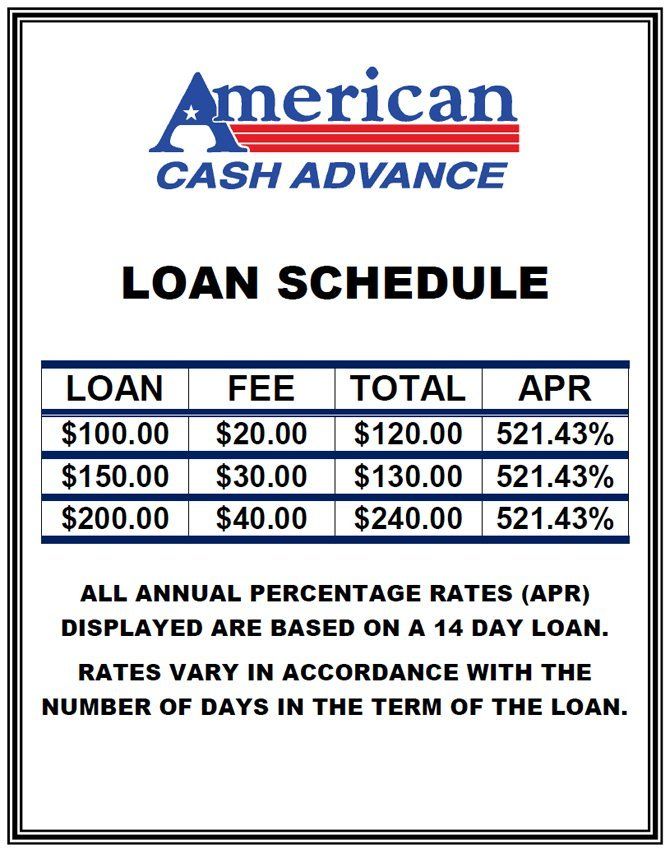

not, The new Hampshire as well as lets higher-notice loans getting degrees of $ten,000 or quicker. Loans are thought higher-appeal if for example the Apr is over 10%. Ergo, of many payday loan and you will term debt collectors operate in The fresh new Hampshire.

It will be tempting to utilize an online payday loan inside the The brand new Hampshire, but the air-large interest levels aren’t worthwhile. It is far better sign up for a classic HELOC that have good credible financial.

Explore a reliable bank

Discover a reputable bank getting a beneficial HELOC by the making certain its licenses try certainly listed on their web site. You can also lookup the financial institution to your Trustpilot to ensure and study online ratings.

Inside the 2023, the brand new Hampshire Agency from Financial recognized an enthusiastic unlicensed person having fun with an on-line system to help customers in getting finance. As they did not have a permit so you can carry out a lending providers, the new Department of Financial instituted a good $39,000 good. It is usually best if you make sure loan providers prior to discussing your very own advice.