Exactly what Tax Versions Do you want From the Financial?

Normally, you can subtract the fresh new entirety of your home mortgage attract, although complete amount relies on new date of home loan, the level of the mortgage, and how you’re using the continues.

So now into your life as much as possible score an income tax deduction on your own home guarantee loan, you may be wanting to know regardless if you should. While your home equity financing useful for your residence advancements qualifies, you need to determine the full mortgage focus whatsoever month-to-month payments are designed. If the deductible expenses – such as the 2nd mortgage appeal costs – is higher than the standard deduction to your most recent tax seasons, it may be worth claiming.

That’s really worth performing only if their deductible expenses add up to more than the level of the standard deduction for the 2020 tax 12 months:

- $24,800 having married people filing together.

- $twelve,400 getting unmarried filers otherwise married couples processing independently.

- $18,650 for lead out-of family.

Till the TCJA out of 2017, every home security fund was indeed tax-deductible, long lasting. Household guarantee funds are no lengthened allowable whether your loan try used for personal things such as getaways, tuition, personal credit card debt, automobiles, outfits, etc.

So you can be considered, you ought to prove the method that you used the financing to allege new HELOC notice taxation deduction. This consists of providing receipts of the many product, labor, and other costs sustained to remodel the property, specialist deals, and just about every other records that presents new suggested utilization of the money, plus Closure

Disclosure and you will financial deed.

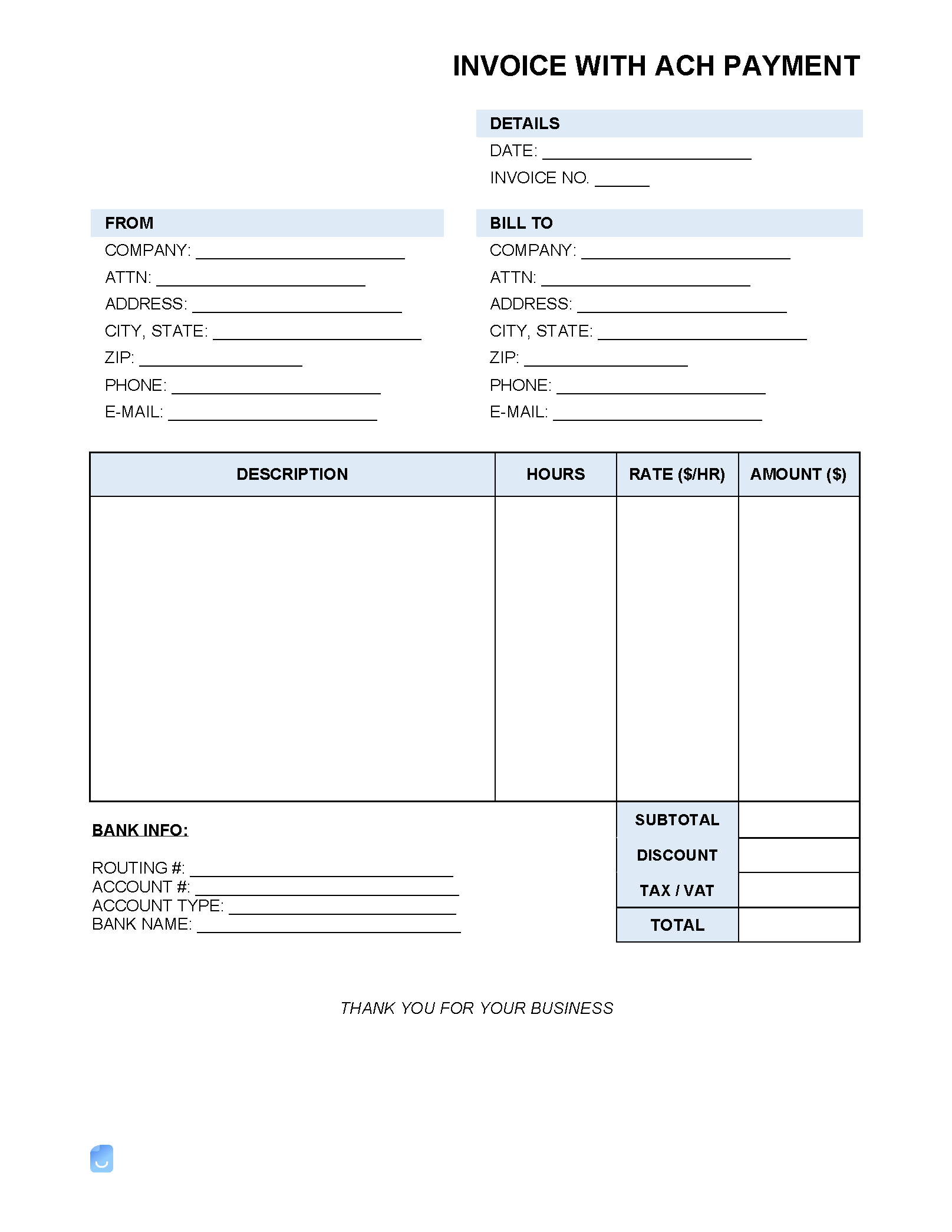

- Home loan Appeal Statement Setting (Mode 1098). Available with your home security mortgage financial, exhibiting the quantity of attract reduced when you look at the previous income tax season. If not discover this type from the bank, you should contact them.

- Statement for additional reduced attract. This will be simply appropriate for those who repaid much more domestic guarantee financing notice than what exactly is revealed on your own Function 1098. You’ll need to write the other appeal number repaid, give an explanation for discrepancy, and gives so it statement along with your income tax return.

- Proof of how household guarantee funds were utilized. These invoices and you may bills will show expenses you to notably improved the latest worthy of, resilience, or adaptiveness in your home – and charges loans Boaz AL for material, labor fees, and you will do-it-yourself it allows.

- Create a folder to store your entire invoices and you may suggestions getting renovations.

- If you have lived-in your property for a long time and you will city homes rates had been going up, a fraction of your obtain available was taxable. In that case, you might reduce the nonexempt acquire from the like the improvements inside the the cost foundation of the house.

- For many who perform a corporate from your own home or book a good portion of your property out to some one, you are capable disregard part of your residence’s modified foundation courtesy decline.

So you can deduct appeal from financing costs, you will need to itemize the fresh new write-offs utilizing the Irs Mode 1040 otherwise 1040-sr. You can either make the practical deduction otherwise itemize – not each other. Once totaling these itemized expenses, examine them to the basic deduction to determine which will render the very best taxation virtue.

The causes out-of HELOC Taxation Write-offs: Asking a taxation Elite group to have Responses

Now you understand the methods to essential questions such as for example is actually home collateral fund tax-deductible and certainly will you disregard family renovations, the work merely delivery. The latest nuances you to get in touch with for each book opportunity and you can circumstances is tricky and the rules can vary.

It’s vital to correspond with a professional tax elite group making yes you are sure that all the income tax ramifications and you may masters you can get be eligible for prior to making people big conclusion. This information you are going to effect although a HELOC ‘s the best choice for your house home improvements. And when its, a specialist can also be be sure to optimize some great benefits of all of the the newest write-offs regarding assembling your shed and you can help you in taking every best files regarding the procedure.