This may are everything from substitution a roof, to get another hot water tank, and you can repairing a damaged driveway

Citizen. Your sustain the expense of keeping the house you possess. If things reduces, as the resident you have to fix-it.

Tenant. You’re not accountable for looking after your family otherwise flat whenever you are considering replacing proprietor-provided devices, repairing plumbing work products, decorate, otherwise restorations. Like with fees, your lease start around new landlord’s guess of your own price of fix however in the end, the new property owner try legally expected to maintain the possessions.

Insurance rates

Resident. Homeowners insurance has to shelter the dwelling plus damages caused by h2o otherwise fire as well as yours land. It should likewise have accountability coverage. Once the homeowners insurance needs to promote way more publicity than clients insurance coverage it does pricing doing seven times the price a tenants policy.

Renter. Renters insurance policy is less expensive than home insurance because simply discusses the expense of your personal property, maybe not this building where you reside. It also is sold with personal accountability insurance though someone is injured with the assets and is their fault.

Security

Citizen. Since you individual your house, any prefer in the really worth (equity) is your personal. Very house boost in well worth through the years in the event, like all opportunities, also can fall-in worthy of. Once you sell the house, you could cash in you to definitely equity while the profit. You don’t need to hold back until your sell to utilize from collateral, although not. You could potentially borrow on brand new guarantee you have obtained thanks to a great style of mortgage choices including property collateral loan, household security personal line of credit otherwise HELOC, otherwise a funds-out refinance of your real estate loan.

Renter. That you do not earn guarantee (otherwise lose it) as you do not own the home otherwise flat for which you real time. Equity, or perhaps the escalation in my site well worth a property gets over time, only would go to the one who possess the house.

Existence

Citizen. If you prefer the room your location, are usually ready to be satisfied with at the very least less than six decades, set-out roots, and maintain a similar occupations, becoming a homeowner could be a good fit for your requirements.

Occupant. For people who enough time to live on somewhere else, use up all your business cover, commonly happy to stay-in place for at the very least around three many years minimum, leasing will make so much more sense for you right now.

Peace of mind compared to. flexibility

Citizen. When you own a property, it cannot getting marketed instead their permission (offered you keep to make costs promptly). If this reassurance resonates highly with you, homeownership is calling.

Renter. Renters trading brand new assurance control will bring for the freedom to help you easily move to a different location. As long as you to definitely independency is essential to you, renting is a better choice, at the very least for now.

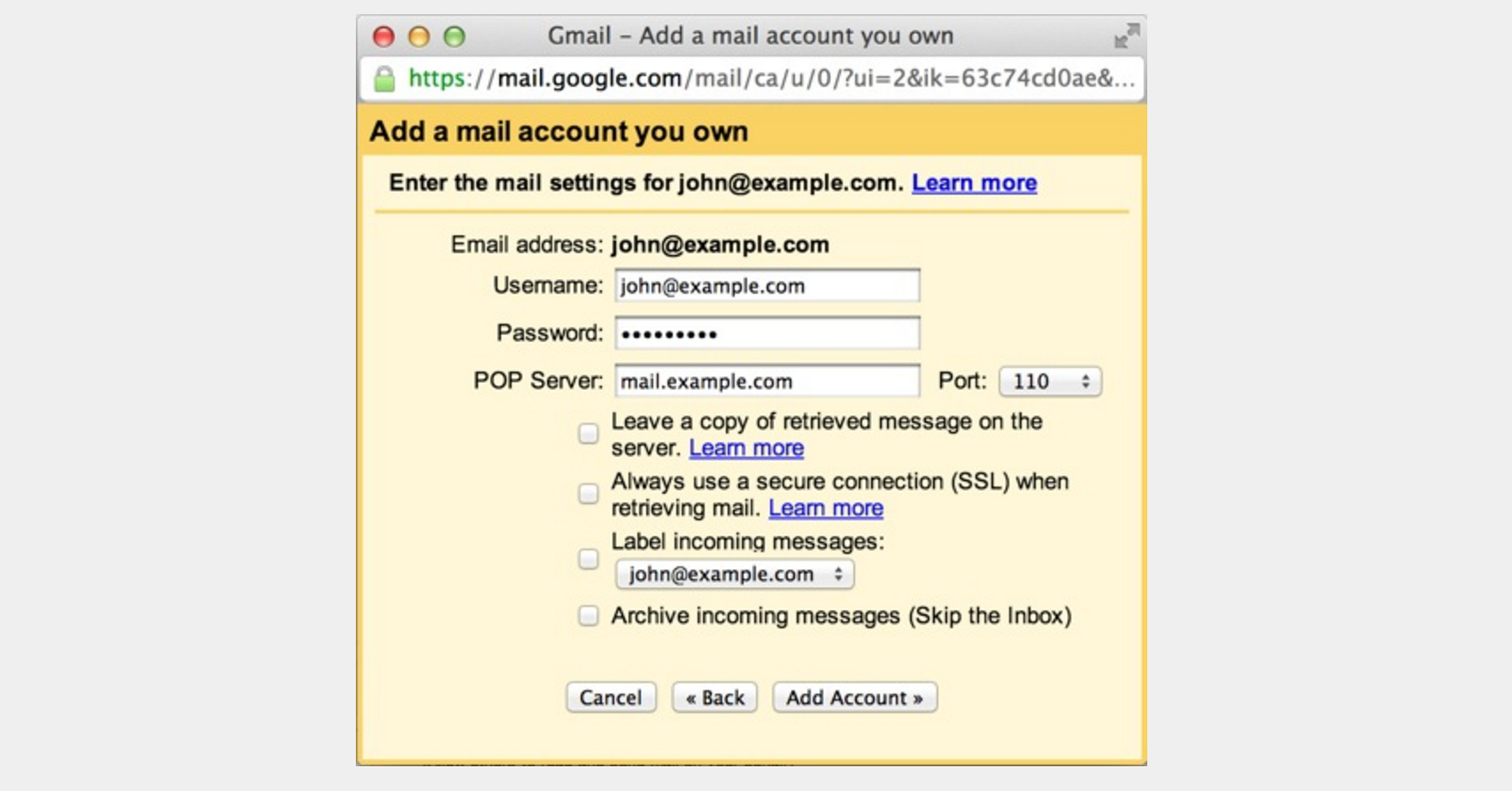

Money

Homeowner. To acquire a house, you really need to use lots of monetary power. Their 20% deposit and you will a good credit score rating end up being the influence you to definitely becomes you that loan for a home well worth repeatedly the amount you spend. Getting you to definitely leverage debt house needs to be within the buy. Need one down-payment, a good credit score, good work, and also the financial wherewithal to make house costs punctually getting the fresh foreseeable future.

Renter. The fresh new economic conditions to possess leasing are not as the strict to own clients, but they aren’t low-existent. To lease a house, you desire the degree of the put, good credit, in addition to capacity to make rent payments promptly.

The expenses away from leasing vs. purchasing

The cost of leasing compared to getting depends mainly how long your stay static in an equivalent home incase economic facts pursue historical trend.