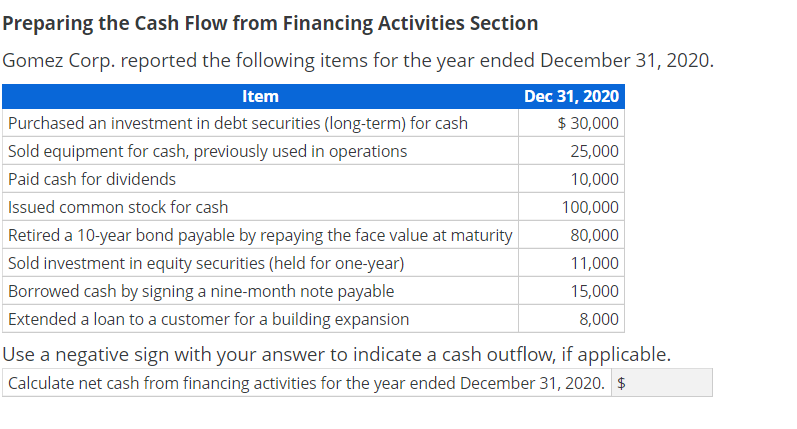

Their genuine rates and you may/or situations is generally additional, as many circumstances go into that delivers a mortgage loan

*Pricing and you may Apr cited significantly more than having Manager-Occupied; 680 credit history; $150,000 ft mortgage; $ loan amount; 96.5% ltv Lowest credit history standards use. Excite consult a great CUFS Subscribed Financial Advisor to possess basic facts. Maximum loan amount: $472,030. (Is lower without a doubt areas) Purchases: step 3.5% down-payment; Refinances: %ltv Rate/Term; 80%ltv Dollars-away

*Rates & Annual percentage rate quoted more than to own Holder-Filled commands; 680 credit rating; $150,000 ft loan; $153,225 amount borrowed; 100% ltv Limitation loan restrictions pertain – varies per Veteran Instructions: 0% down-payment; Refinances: 100%ltv Price/Term; 90%ltv Cash-away

*Rates & Annual percentage rate quoted above to possess Owner-Filled orders; 680 credit rating; $150,000 legs financing; $151,515 loan amount; 100% ltv Minute 620 credit score. Purchases: 0% downpayment; Geographic and you can money constraints pertain. Take a look at here for eligibility.

*Prices and you will Apr quoted more than to own Owner-Occupied; 760+ credit scores; $step one,000,000 loan; 75% ltv. Loan-to-Value over 75% might have yet another rates & Apr. *Rates can vary based on credit worth loan-to-worthy of, occupancy, mortgage method of, and you can mortgage name. Showed would be the newest lowest readily available prices. Rates and you can APRs released try at the mercy of changes with no warning. When you yourself have issues or do not understand the certain mortgage system and you can/otherwise condition that you are wanting, delight get in touch with financing Administrator for a customized price by the contacting (800) 503-6855.

2476 Lawernceville Hwy., Suite 101 | Decatur, GA 30033 | [current email address safe] | Phone: (800) 503-6855 | Fax: (678) 658-4467

Michelle Wright

Michelle Wright serves as Maintenance Manager to possess Borrowing Connection Financial Services, LLC (CUFS) for the Covington, Georgia. She first started their own field that have CUFS as a mortgage loan Servicer during the 1998. As her industry state-of-the-art, Michelle transitioned to help you a good Michelle was promoted in order to their latest role. The woman is accountable for loss minimization, home loan company conformity relating to Home Payment Steps Operate (RESPA) and you will User Economic Shelter Agency (CFPB), month avoid and you can one-fourth avoid revealing, in addition to general home loan maintenance.

Michelle lives in payday loan Meriden Stockbridge. She graduated that have good Bachelor’s Degree within the Psychology on the College or university regarding Maryland, Eastern Shore in the 1991.

Jim Dymek

Jim Dymek started in the mortgage providers as an authorized Financial Coach during the helping home financing Banker. Jim’s earlier in the day community was attempting to sell technology to help you Fortune 500 companies for just as much as fourteen decades regarding the The southern area of.

Leveraging their mortgage sense, Jim returned to technology career of 2011 to help you 2014 attempting to sell financial technology choice having Calyx Application and you can Credit QB from the The southern part of Us.

Jim have consistently been in the top ten% out of design in the certain home loan enterprises because of the primarily centering on teaching the user and delivering thorough follow up.

Jim try excited about teaching the user to the axioms with a focus toward explaining essential borrowing is within the mortgage approval techniques. Jim prides himself on offering the user multiple choices in the place of just one mortgage alternative. Jim even offers a powerful knowledge of compliance and also the most recent guidelines governing a.

A resident away from Dunwoody, Jim moved to the fresh Region Atlanta town into the 1974. He attended Dunwoody High-school and is an excellent 1985 graduate out of Georgia Technology having a good Bachelor’s Studies during the Industrial Administration.

David Gowen

David was a home loan Licensed Home loan Mentor from the Borrowing Partnership Financial Services during the Covington, Georgia. He facilitate promote mortgage answers to people in Borrowing from the bank Unions into the Georgia. Once starting in the borrowed funds world in 1986, David spent the original 21 years of his career working in an individual fund industry with general otherwise correspondent lenders given that either a single manufacturer or transformation manager. Once the 2007, he has got struggled to obtain multiple financial institutions or mortgage brokers talking about people possibly due to the fact one manufacturer or department manager.