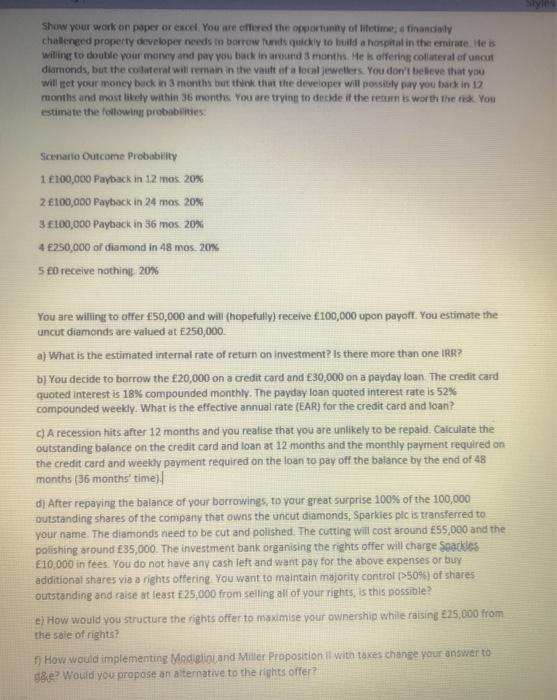

Advantages of HELOC versus. house equity mortgage

Along with letting you make use of your home equity, these types of capital products bring more positives. Let us evaluate a few of all of them.

HELOC benefits

HELOC money leave you alot more credit flexibility than simply family equity loans. As you have a long mark several months, you can access precisely the amount of money you would like installment loans Riverside WA, right when you need it. This means that, this could help you ward off borrowing also much.

The fresh cost procedure for a great HELOC includes gurus as well. Some think it’s easier to cover small repayments into the drawing several months. At that time, you may get ready for the larger payments that you’ll create from inside the payment several months.

HELOCs might have lower rates than simply household guarantee loans and you can unsecured borrowing options particularly credit cards. More over, if you utilize the latest HELOC’s funds on qualified domestic renovations, this new Irs can even allow you to deduct the attention paid back toward your own taxation return.

Family guarantee loan positives

If you’d like your money at a time, you are able to like the lump sum payment one to a property collateral loan brings therefore the predictability which comes from it. The best domestic collateral finance function repaired interest rates and you may steady fee amounts. Their cost management becomes easier after you know the way much you may have to pay per month.

Even if house equity fund might have highest interest rates than HELOCs, you’ll be able to generally speaking nonetheless save money more solutions like playing cards. (If you are struggling with highest-focus credit debt currently, you are able to pay they off using a house security loan). At exactly the same time, the newest fixed price setting you won’t need to worry about rising interest levels raising the cost of the debt. The new government income tax deduction to have notice paid off applies to home security funds as well.

Since you find out more about house guarantee, youre bound to look for the newest words Household Guarantee Range of Borrowing from the bank, or HELOC and Domestic Security Financing. They are both choices to use the security of your home in order to finance other expenditures that you know. HELOCs and you will Domestic Guarantee Fund function differently and you will serve various other monetary goals. Why don’t we look at the key differences between HELOCs and you will property security loan.

HELOC: Definition & Benefits

A home Collateral Line of credit is precisely you to definitely, a personal line of credit you take out, similar to a credit line you have made of a card credit. Same as a credit card, you are provided a borrowing limit based on how far you may use of house’s collateral. There are lots of things that place HELOC’s aside.

Flexibility: You could potentially borrow money, repay the bucks, and you can acquire again providing you sit in your recognized credit limit. This even offers many independency across the drawing months, that’s usually 5 so you can ten years much time.

Rates: HELCOs most frequently feature varying rates, which means that new payment per month you will be making changes or change with respect to the interest rate and field conditions.

Straight down 1st Money: Inside drawing several months, you are able to money to your precisely the attract, meaning lower monthly premiums initial. You could lower their attention otherwise concept about attracting several months, definition you would has actually lower costs from inside the repayment several months.

Of several Spends: HELOCs can be used for several objectives and certainly will help you to get just before obligations from the combining all obligations with the one to fee. It also helps you which have house renovations, degree expenses, and.

Home Equity Financing

Property Guarantee Mortgage try really really-known as the next mortgage. That it mortgage now offers a lump sum of money which is lent against somebody’s family guarantee. It operates way more in a different way than just a HELOC and much more such as for instance that loan otherwise financial.